Algorithmic Trading: The Role of Artificial Intelligence in Modern Financial Markets

In recent years, the landscape of financial markets has undergone a profound transformation with the rise of algorithmic trading, powered by artificial intelligence (AI). Algorithmic trading involves the use of computer algorithms to execute trades at high speeds and frequencies. The integration of AI technologies has further enhanced the capabilities of algorithmic trading, bringing efficiency and sophistication to modern financial markets.

1. Automated Decision-Making:

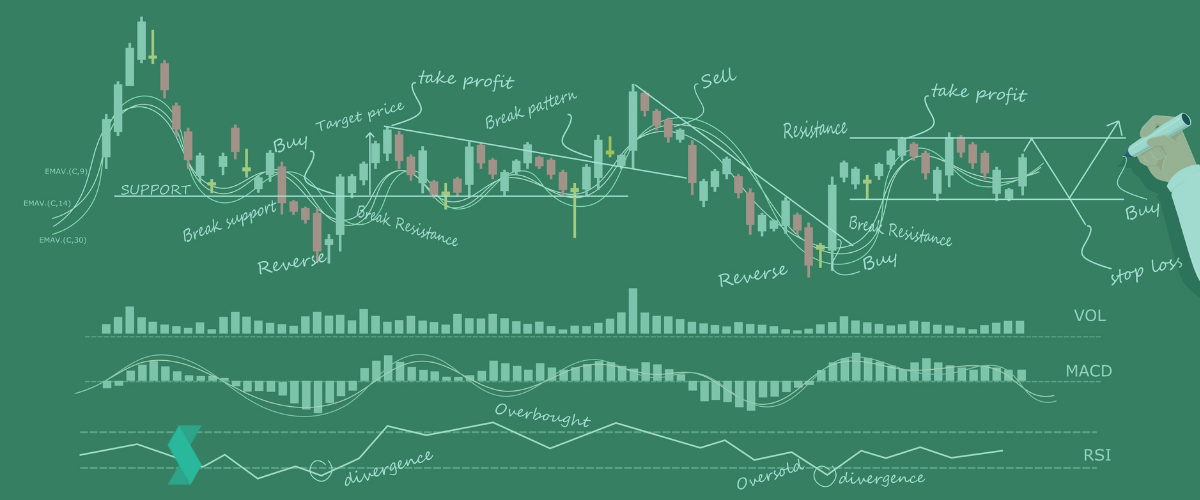

One of the primary advantages of algorithmic trading with AI is the ability to automate decision-making processes. AI algorithms can analyze vast amounts of data in real-time, identifying patterns and trends that human traders might overlook. This automation allows for rapid and precise execution of trades based on predefined criteria.

2. Machine Learning in Trading:

Machine learning, a subset of AI, plays a pivotal role in algorithmic trading. These algorithms can adapt and improve over time by learning from historical data. Machine learning models can recognize evolving market conditions, optimize trading strategies, and even predict future price movements. This adaptive capability gives algorithmic trading a significant edge in dynamic markets.

3. Risk Management and Predictive Analytics:

AI-driven algorithms excel in risk management through advanced predictive analytics. These algorithms can assess market volatility, identify potential risks, and adjust trading strategies accordingly. By incorporating risk models and stress testing, AI helps mitigate potential losses and protect capital in unpredictable market conditions.

4. High-Frequency Trading (HFT):

AI-driven algorithmic trading is the backbone of high-frequency trading, where trades are executed in milliseconds. The speed and precision offered by AI algorithms enable market participants to capitalize on minute price differentials, making thousands of trades within a short timeframe. HFT has become a dominant force in modern financial markets.

5. Market Liquidity and Efficiency:

Algorithmic trading contributes to market liquidity and efficiency by facilitating a continuous flow of trades. AI algorithms help match buyers with sellers, reducing bid-ask spreads and enhancing overall market liquidity. The increased efficiency benefits all market participants by ensuring that trades are executed at fair and competitive prices.

6. Regulatory Challenges and Ethical Considerations:

The widespread adoption of algorithmic trading has raised regulatory challenges and ethical considerations. Regulators grapple with issues such as market manipulation, fairness, and the potential for systemic risks associated with automated trading. Striking a balance between innovation and market integrity remains a ongoing challenge for financial authorities.

Conclusion:

Algorithmic trading, driven by artificial intelligence, has revolutionized the way financial markets operate. The integration of AI algorithms has brought efficiency, speed, and predictive capabilities to trading strategies. However, as with any technological advancement, there are challenges to address, including regulatory concerns and ethical considerations. As AI continues to evolve, its role in shaping the future of financial markets is certain to expand, further blurring the lines between human and machine-driven trading.